Sharjah has increasingly caught the eye of property investors, especially those asking, is it worth buying property in Dubai? But is it the perfect fit for you?

Buckle up, as we dive into the pros, cons, and all you need to know about buying property in Sharjah.

Why Sharjah Is a Jewel for Property Investors Asking, “Is It Worth Buying Property in Dubai?”

Affordable As Compared To Dubai:

Compared to its glitzy neighbor, Dubai, Sharjah boasts significantly lower property prices.

Analyzing the market, there are several price ranges for villas in Dubai: Economy villas – prices start at around AED 3-4 million. Mid-range villas – prices range between AED 4-8 million. Luxury villas – prices start at AED 8 million and can reach tens of millions of AED for the most exclusive properties. For those wondering is it worth buying property in Dubai, these price tiers offer a clear view of what different budgets can access.

Whereas,

The cost of owning a villa in Sharjah varies widely depending on the location, size, and amenities. On average, villa prices usually starts from AED 1.5 million to AED 5 million.

This makes it a dream destination for first-time buyers and budget-conscious investors seeking a healthy return.

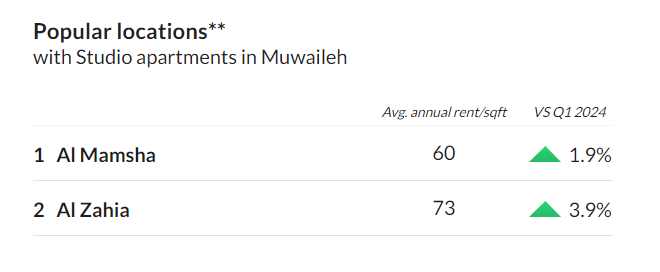

Rental Yields:

The average price for flats rented in Dubai is AED 68,150.

The average asking rental price in Sharjah is AED 37,732 per year.

The yearly rental yeild as compared to proeprty prices brings more % return on your investment which attracts investors.

Sharjah’s rental market is flourishing, thanks to a growing population. This translates to attractive rental yields, making your property a cash flow machine, especially for those weighing the question, is it worth buying property in Dubai?

Sharjah Strategic Location:

Sharjah’s strategic positioning offers excellent connectivity to Dubai and other emirates. This, coupled with its developing infrastructure, makes it a prime residential and commercial hub.

Variety of Property Options:

From modern apartments to sprawling villas, Sharjah caters to a range of lifestyles and budgets. You’re sure to find a property that aligns perfectly with your needs.

Considering the Other Side of the Coin

Limited Freehold Areas:

Unlike Dubai, freehold ownership is restricted to specific zones in Sharjah. Freehold areas have become increasingly significant, offering both residents and investors lucrative opportunities. Be sure to research these designated areas before diving in.

A Cultural Heritage:

Sharjah upholds a more conservative and family-oriented lifestyle compared to Dubai. If a vibrant nightlife scene is high on your priority list, Sharjah might not be the ideal fit, something to consider when asking, is it worth buying property in Dubai?

As a Culture Capital of the UAE, Sharjah celebrates its heritage and traditions in museums and centres from Sharjah City to the Central Regions.

Sharjah vs. Dubai: The Investment Showdown

While Dubai offers a cosmopolitan lifestyle and potentially higher capital appreciation, Sharjah wins in terms of affordability and rental yields, factors to weigh when asking, is it worth buying property in Dubai?

The choice ultimately boils down to your priorities and risk tolerance.

Related Queries to Consider

Buying property in Sharjah is an exciting step, but financing it requires careful planning.

Here’s a breakdown of your options:

Mortgages:

The most common route, mortgages are offered by banks and Islamic lenders.

Conventional mortgages come with interest rates, while Islamic financing uses Sharia-compliant structures like Ijara (leasing) or Musharaka (partnership).

Down Payment:

Sharjah regulations typically require a down payment of 20-25% for UAE nationals and 15-20% lower for expats (depending on property value). It’s best to plan and save up this amount, especially if you’re also considering whether is it worth buying property in Dubai.

Eligibility Criteria:

Banks assess your income, credit score, and employment status to determine eligibility and loan amount. Maintaining a good financial standing is key.

Pre-Approval:

Getting pre-approved for a mortgage clarifies your budget and strengthens your negotiating position with sellers.

Navigating the Legalities While Owning Property in Sharjah

Understanding the legalities is vital for a smooth property purchase in Sharjah, especially if you’re also asking, is it worth buying property in Dubai? Here’s a crucial checklist:

Freehold vs. Leasehold:

Sharjah has designated freehold areas where you own the property and land. Leasehold grants you ownership of the building on leased land, usually for long durations (up to 99 years).

Ownership Deed (Title Deed):

This document confirms your ownership. Ensure it’s registered with the Sharjah Land Department.

Fees and Taxes:

Be prepared for registration fees (around 2% of the property value), property transfer fees (around 4%), and service charges (depending on the community).

“There are no income or property taxes in Sharjah.”

Ejari Registration:

This mandatory registration process with Ejari (rental disputes settlement authority) documents your tenancy agreement.

Tips for Selecting a Real Estate Agent in Sharjah

Having a trustworthy real estate agent by your side can make a world of difference.

Here are some pointers to find the perfect fit:

Experience and Local Knowledge:

Look for agents with a proven track record in Sharjah, especially in your desired area. Local knowledge is invaluable in navigating the market.

Licensing and Registration:

Ensure your agent is licensed by the Sharjah Real Estate Regulatory Authority (SERA) for complete peace of mind.

Reputation and Reviews:

Research online reviews and ask for recommendations from friends or colleagues who have recently bought property in Sharjah.

Transparency and Communication:

Choose an agent who clearly explains processes, fees, and market trends. Open communication is key to a successful partnership.

By exploring these financing options, legal considerations, and tips for finding a real estate agent, you’ll be well-equipped to navigate the property market in Sharjah and make an informed investment decision.

Conclusion

Sharjah’s property market presents a compelling proposition for investors seeking a balance between affordability, rental returns, and strategic location.

By carefully weighing the pros and cons, and conducting thorough research, you can determine if Sharjah is your property paradise.

Frequently Asked Questions (FAQs)

Is Sharjah a good investment for long-term capital appreciation?

Property prices in Sharjah have shown steady growth, suggesting good potential for long-term capital gains. However, real estate markets are dynamic, so conduct thorough research before making a decision.

What are the best areas to invest in Sharjah?

Areas like Al Taawun, Al Zahia, and Al Khan are popular choices due to their proximity to amenities, infrastructure, and good rental yields.

What are the fees associated with buying property in Sharjah?

Expect to pay registration fees, property transfer fees, and agent fees (if applicable).