The real estate market in Sharjah, one of the emirates of the UAE, has been experiencing rapid growth and transformation.

Known for its cultural heritage, educational institutions, and family-friendly environment, Sharjah is gradually becoming a hub for real estate investors.

As cities around the world undergo continuous development in their real estate sectors, Sharjah stands out for its unique blend of affordable properties and attractive returns.

In this article, we’ll compare Sharjah’s real estate market with global markets, evaluating various factors like property prices, rental yields, investment potential, and more.

Great Time To Invest In Sharjah

Here are tips to capitalise on the ongoing upcycle:

- Consider buying established prime properties that offer good rental income potential. The demand for high-quality housing and commercial space will continue to rise.

- Land in areas with strong development prospects could appreciate handsomely in value. Identify sites aligned with future urban expansion plans.

- Commercial assets like offices, warehouses, and retail spaces in high-growth sectors make solid investments, as their demand is set to grow.

- Seek attractive pre-launch deals from reputable developers for upcoming projects in prime locations for a huge upside.

- For end-users, negotiate hard with sellers for homes in desirable communities as prices are still relatively affordable.

Work with a real estate consultant to identify discounted distressed assets from motivated sellers for big bargains in the global market.

Sharjah Real Estate Market Overview

Key Factors Driving Sharjah’s Real Estate Growth

Sharjah’s real estate market has been growing due to several factors, including its strategic location between Dubai and the northern emirates, diversified economy, and rapidly growing population, making it an increasingly attractive part of the global market.

Unlike its more expensive neighbor, Dubai, Sharjah offers affordable housing options, making it an attractive destination for both expatriates and locals.

The government’s investor-friendly policies and infrastructure development have also contributed to the rise of Sharjah’s real estate sector.

Market Segmentation (Residential, Commercial, Industrial)

The real estate market in Sharjah can be divided into three major segments:

- Residential properties, which range from affordable apartments to luxury villas.

- Commercial properties, which cater to businesses and startups.

- Industrial real estate, which includes warehouses and logistics centers, is supported by Sharjah’s status as a key logistics hub.

Trends In Sharjah’s Real Estate Sector

Recent trends in Sharjah’s market include an increase in demand for residential units due to population growth, as well as a surge in interest from foreign investors looking for affordable real estate options with high rental yields in the global market. The emirate’s growing industrial sector has also spurred demand for commercial and industrial properties.

Global Market Overview for Real Estate

Major Global Real Estate Markets

The global real estate market is vast and varied, encompassing major cities like New York, London, Tokyo, and Sydney.

Each of these markets has its own unique dynamics, driven by local economic conditions, demand, and regulatory frameworks. However, what they share is the rising cost of property, especially in prime locations.

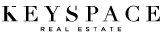

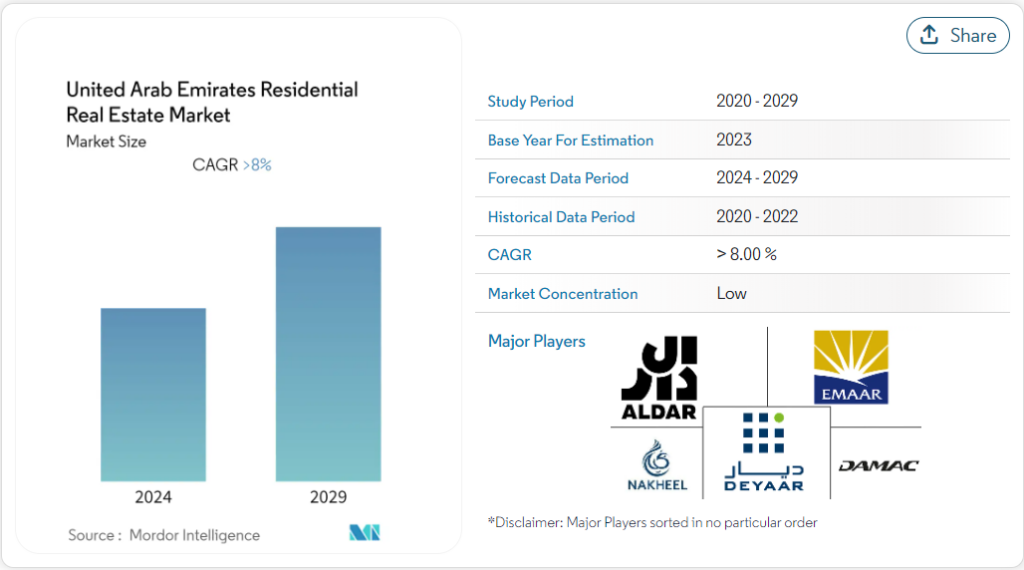

Key Players in the Global Real Estate Market

Key players in the global real estate market include institutional investors, government agencies, and multinational corporations, all seeking high returns on property investments. The influx of foreign investments has significantly impacted property prices in major cities worldwide.

Comparing Property Prices

Residential Property Prices in Sharjah vs. Global Cities

One of Sharjah’s strongest selling points in the global real estate market is its affordability compared to major global cities. For instance, while property prices in cities like London or New York are skyrocketing, Sharjah remains relatively affordable. A typical apartment in Sharjah costs a fraction of what a similar-sized property would cost in these global cities.

Affordability Index Comparison

When comparing the affordability index, Sharjah scores higher due to its lower cost of living and property prices. Many expatriates working in Dubai choose to live in Sharjah for this reason, allowing them to save significantly on housing costs.

Commercial Property Pricing Trends

Commercial property in Sharjah is also more affordable compared to global cities, with lower rental rates and purchase prices for office spaces and retail outlets. This affordability is driving demand from small and medium enterprises (SMEs) looking for cost-effective office spaces.

Rental Yields and Returns on Investment

Rental Yields in Sharjah

Rental yields in Sharjah remain high, particularly in residential sectors. Investors can expect returns of 6-8% annually, which is competitive when compared to global cities where rental yields tend to be lower due to the high property prices.

Global Rental Yields Comparison

In comparison, cities like London or New York typically offer lower rental yields (around 3-4%), making Sharjah an attractive alternative for investors seeking higher returns on investment.

Government Regulations and Policies

Sharjah’s Regulatory Environment for Real Estate Investors

Sharjah’s government has implemented several regulations to promote real estate investment, including long-term visas for property owners and easing restrictions on foreign ownership in certain areas. These policies have contributed to increased investor confidence in the market.

Comparison with Global Real Estate Regulations

Globally, real estate regulations vary widely. While some countries have stringent policies on foreign ownership and property taxes, Sharjah’s regulatory environment is relatively investor-friendly, which has helped to attract a diverse range of investors from around the world.

Investment Opportunities and Risks

Investment Potential in Sharjah

Sharjah’s real estate market presents a wealth of investment opportunities, especially in the residential and commercial sectors.

The emirate’s affordable property prices, high rental yields, and the government’s proactive policies aimed at attracting foreign investment make it an appealing choice.

Sharjah is also strategically positioned near Dubai, which has a spillover effect, allowing investors to benefit from Dubai’s proximity while investing in a more affordable market.

Furthermore, ongoing infrastructure projects, such as new highways and transportation links, are enhancing the connectivity of Sharjah to the rest of the UAE, further boosting its appeal.

Industrial real estate is also seeing substantial growth, given the demand for logistics hubs and warehousing space due to Sharjah’s robust import-export activities.

Investment Risks Globally vs. Sharjah

While Sharjah offers significant opportunities, no market is without risks. Globally, real estate markets can fluctuate due to economic downturns, regulatory changes, or natural disasters.

Sharjah is relatively stable but still faces challenges like over-supply in certain sectors and slower economic diversification compared to Dubai or Abu Dhabi.

Global investors in the global market need to be aware of risks such as market liquidity, currency fluctuations, and geopolitical instability in other regions. Sharjah, however, benefits from being in a politically stable country with a strong economy, minimizing these types of risks.

Foreign Investment and Ownership Policies

Sharjah has gradually relaxed its property ownership laws for foreigners, making it easier for international investors to enter the market.

Foreigners can now own property in designated areas and benefit from long-term visas based on property investments.

This regulatory framework is more relaxed compared to some global markets where foreign ownership may be restricted or heavily taxed, thus making Sharjah an attractive option.

Market Demand and Demographics

Population Growth and Demand for Real Estate in Sharjah

Sharjah’s population has been growing steadily, driven by an influx of expatriates seeking affordable housing and a family-friendly environment.

This has fueled demand for residential properties in the global market, especially in the affordable housing segment. As more families move to the emirate, there is also increasing demand for schools, retail centers, and recreational facilities, which is further driving the real estate market.

Demographic Trends Influencing Global Real Estate Markets

On a global scale, demographic trends play a critical role in shaping real estate markets. Aging populations in Europe and Japan, for example, have led to increased demand for retirement housing and healthcare facilities.

Meanwhile, cities with younger populations, like those in Southeast Asia, are seeing a surge in demand for urban housing and tech-enabled properties.

Sharjah’s youthful and growing population aligns more with global cities experiencing housing demand, which positions the emirate well for future growth.

Infrastructure Development

Ongoing and Future Infrastructure Projects in Sharjah

Infrastructure plays a pivotal role in real estate development, and Sharjah is no exception. The emirate has invested heavily in upgrading its road network, enhancing public transport options, and expanding its airport to increase international connectivity.

Major infrastructure projects, such as the Sharjah International Airport expansion and new highways, are likely to bolster property values in nearby areas.

Sharjah’s focus on developing eco-friendly public spaces, waterfront developments, and industrial zones is also expected to enhance the livability of the emirate, making it even more attractive to residents and investors alike.

Global Infrastructure Developments and Their Impact on Real Estate

Globally, infrastructure investments often lead to a surge in real estate demand. Cities like Singapore, London, and Los Angeles have seen property prices rise significantly following the construction of new transit lines, airports, or business districts.

Sharjah’s infrastructure improvements follow a similar pattern, with real estate developers and investors closely watching these developments for potential opportunities.

Sustainability and Green Buildings

Green Building Initiatives in Sharjah

Sustainability is increasingly becoming a key focus for Sharjah’s real estate developers. Green building practices, such as the use of energy-efficient materials, water conservation technologies, and renewable energy solutions, are being incorporated into new developments.

These initiatives are aligned with the UAE’s overall goals to reduce carbon emissions and promote sustainability across all sectors.

Some new residential and commercial projects in Sharjah are now being designed to meet green building standards, which not only reduce environmental impact but also provide long-term cost savings for property owners through lower utility bills.

Global Trends in Sustainable Real Estate Development

Globally, the real estate industry is shifting toward sustainability. In cities like Stockholm, Vancouver, and Melbourne, green buildings are becoming the norm, with local governments providing incentives for sustainable development.

Sharjah is slowly catching up to these global trends, with the potential to further align itself with international best practices in sustainable real estate.

Technology and Innovation in Real Estate

Digital Transformation in Sharjah’s Real Estate

Technology is revolutionizing Sharjah’s real estate market. The adoption of digital platforms for property listings, virtual tours, and online transactions is streamlining the buying and selling process for both developers and consumers.

Additionally, the use of smart home technologies in new residential developments is gaining traction, as more homebuyers seek tech-enabled living spaces with automation features and energy-efficient systems.

Global Tech Innovations Impacting Real Estate Markets

Globally, the real estate sector has been quick to adopt technological advancements, from blockchain for secure property transactions to artificial intelligence (AI) for predictive market analytics.

These technologies have the potential to disrupt traditional real estate models by making the process more transparent and efficient.

Sharjah’s real estate market is gradually incorporating these innovations, positioning itself as a forward-thinking player in the regional market.

Economic Factors Affecting Real Estate

Sharjah’s Economy and Its Impact on the Real Estate Market

Sharjah’s economy is diversified, with strong sectors in manufacturing, logistics, and education. These economic drivers support the demand for real estate, especially in the commercial and industrial sectors.

The emirate’s real estate market is further supported by stable economic growth, making it a relatively safe option for long-term investments.

Global Economic Trends and Their Effect on Real Estate

Globally, real estate markets are influenced by economic conditions such as inflation, interest rates, and unemployment levels.

Economic downturns, such as the 2008 financial crisis or the COVID-19 pandemic, have shown how vulnerable real estate markets can be to macroeconomic changes.

Sharjah’s market, while impacted by these global trends, has proven resilient due to its focus on affordable housing and strong demand from expatriates.

Foreign Direct Investment (FDI) in Real Estate

FDI in Sharjah’s Real Estate Sector

Foreign direct investment (FDI) has played a critical role in Sharjah’s real estate market. The emirate has attracted investors from countries like India, Pakistan, and the UK, drawn by its affordability and potential for high returns.

Recent regulatory changes have made it easier for foreign investors to purchase property in Sharjah, contributing to the market’s growth.

Comparison with Global FDI Trends in Real Estate

Globally, FDI in real estate is concentrated in major cities like New York, London, and Hong Kong. While these cities offer significant investment opportunities, they are also highly competitive and expensive markets to enter.

Sharjah, in contrast, provides a more accessible entry point for foreign investors seeking to diversify their portfolios without the prohibitive costs associated with top-tier global cities.

Challenges Facing Sharjah’s Real Estate Market

Local Challenges

Despite its growth, Sharjah’s real estate market faces challenges in the global market. Over-supply in the residential sector has led to downward pressure on rental rates in some areas, which could impact investor returns.

Additionally, competition with neighboring Dubai, a more established and internationally recognized real estate market, poses a challenge for Sharjah in attracting high-end investors.

Global Challenges Comparison

Globally, real estate markets face a range of challenges, including housing affordability crises, regulatory changes, and the need for sustainable development.

Sharjah shares some of these challenges, particularly in terms of affordability and sustainability, but benefits from a stable political and economic environment, which mitigates many of the risks seen in other global markets.

In conclusion, while Sharjah’s real estate market is smaller and less developed than many global markets, it offers distinct advantages, including affordability, high rental yields, and a favorable regulatory environment.

Investors seeking diversification and long-term growth may find Sharjah to be a compelling alternative to more expensive global markets.

With ongoing infrastructure developments, green building initiatives, and a growing population, Sharjah is well-positioned for continued real estate growth in the coming years.

FAQs

1. What are the key differences between Sharjah and global real estate markets?

Sharjah offers more affordable property prices and higher rental yields compared to many global markets, with a regulatory environment that is highly favorable to foreign investors.

2. Is Sharjah a good investment destination for real estate?

Yes, Sharjah is an attractive destination for real estate investment due to its affordability, high rental yields, and stable economic and political environment.

3. How do Sharjah’s property prices compare to other major global cities?

Sharjah’s property prices are significantly lower than in cities like New York, London, or Hong Kong, making it an affordable option for investors seeking entry into the global market and the UAE’s property sector.

4. What are the risks of investing in Sharjah’s real estate market?

The main risks include potential over-supply in certain sectors and competition from neighboring Dubai. However, the market is relatively stable compared to global real estate hubs.

5. How does Sharjah’s real estate market align with global sustainability trends?

Sharjah is adopting green building initiatives that align with global trends towards sustainability in real estate development. However, it is still in the early stages compared to more advanced global markets like Stockholm or Vancouver.