Have you ever dreamt of owning a piece of prime real estate but felt priced out by the hefty down payments and ongoing costs?

Well, fret no more! Real estate crowdfunding might be the key to unlocking that dream.

In this blog, we’ll delve into the world of real estate crowdfunding featuring UAE, exploring its ins and outs, potential benefits and drawbacks, and answering all your burning questions.

So, buckle up, aspiring real estate moguls (or mini-moguls)!

What is Real Estate Crowdfunding?

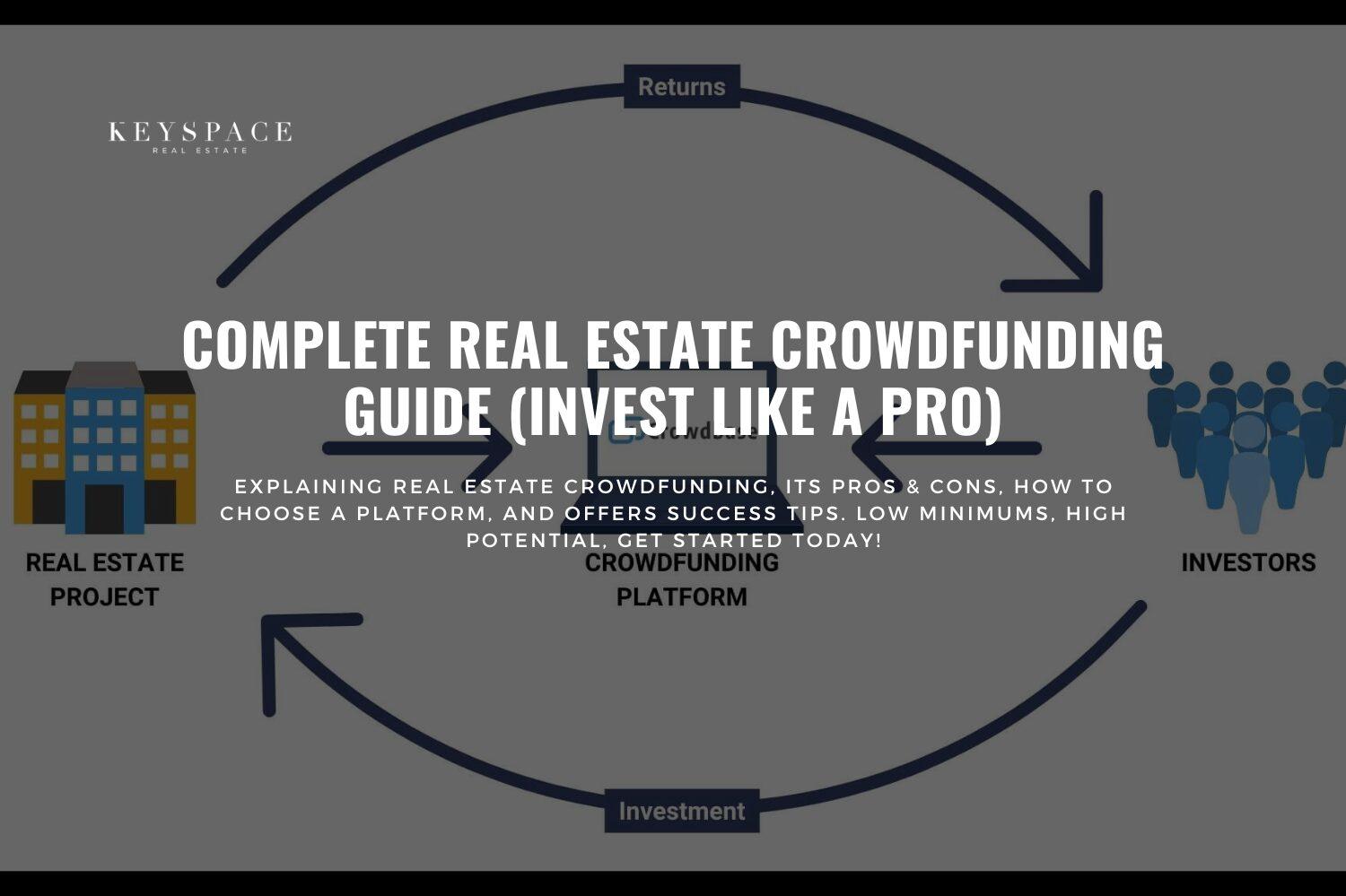

Imagine this, a bunch of people pool their money online to invest in a real estate project. That, in essence, is real estate crowdfunding.

Through online platforms, in accordance with The Financial Services Regulatory Authority (FSRA) and the Central Bank Rule Book published by UAE authorities, individuals with varying investment capacities can collectively fund lucrative real estate ventures, which were traditionally reserved for high-net-worth individuals or institutions.

How Does it Work?

Here’s a simplified breakdown:

- Project Selection: Real estate developers or sponsors list investment opportunities on crowdfunding platforms. These projects could be anything from apartment buildings to shopping centers.

- Investor Participation: Investors browse the listed projects, research their potential, and choose ventures that align with their investment goals.

- Investment & Ownership: Depending on the platform and project, investors can contribute funds towards debt (loans) or equity (ownership) in the property.

- Profit Sharing: Once the property generates income (through rent or sale), profits are distributed among investors based on their contribution.

The Ifs and Else’s: Who Can Invest?

Crowdfunding regulations vary depending on your location. In the US, for instance, there are two main categories of investors:

- Accredited Investors: These individuals or entities meet certain income or net worth thresholds, allowing them access to a wider range of investment opportunities.

- Non-Accredited Investors: This category encompasses most individuals. Their investment options might be limited, but some platforms do cater to them.

2 Of The Most Popular REAL ESTATE CROWDFUNDING Platforms In the UAE

GET STAKE

Thousands of investors worldwide use Stake to access income-generating real estate deals in high-growth markets, starting from just AED 500.

When investing, you’ll receive a Title Deed and Share Certificates as proof of ownership, and no banks or creditors can claim your assets. Stake has a DFSA-regulated Business Cessation Plan to minimize disruption and completely protect your investments.

Yes, low liquidity but overall high annualized return like 6% and you can see the value of your investment over time and actually get rent payments.

They are opening their secondary market on 2nd May, 2024 (probably launched while you are reading this).

SMARTCROWD

Invest in real estate and start generating a passive income with the region’s first DFSA regulated real estate crowdfunding platform, Regulated by DFSA

Invest in Dubai’s real estate using data-driven analysis and third-party valuation. Once you make your investment, you can sit back, relax, and watch your wealth grow.

INVESTING WITH REITS (Real Estate Investment Trust)

If you are looking to invest in REITs based in UAE, currently there is Emirates REIT and ENBD REIT.

Both are listed on NASDAQ Dubai, Please go through the link for more information.

For reit specifically, look for the properties they hold, the management fees charged, the revelation and devaluation of properties, and their trend.

Please go through the prospectus of respective REITS before investing and also have a look at how liquid it is(observe the trading pattern).

Emirates REIT is the UAE’s largest listed Sharia-compliant Real Estate Investment Trust (REIT).

As the same as above, ENBD REIT also is a Sharia-compliant, real estate investment trust investing in income generating real estate, with a primary focus on the UAE.

The Pros and Cons: Weighing Your Options

Like any investment, real estate crowdfunding has its advantages and disadvantages:

Pros:

- Low Investment Minimums: You can potentially invest with just a few hundred dollars, making it accessible to a broader range of investors.

- Diversification: Spread your investment across multiple properties, mitigating risk compared to a single property purchase.

- Passive Income: Earn rental income or profit from property appreciation without the hassle of direct property management.

- Access to Exclusive Deals: Invest in projects not readily available through traditional means.

Cons:

- Illiquidity: Your investment is typically tied up for several years, limiting your access to that capital.

- Higher Risk: Crowdfunding ventures are often startups or involve unproven properties, leading to a higher chance of losing your investment.

- Lower Returns (Potentially): Compared to directly owning a property, returns might be slightly lower due to platform fees and profit sharing.

- Less Control: You have minimal decision-making power regarding property management or the future course of the project.

FAQs: Your Real Estate Crowdfunding Q&A

Q: Is real estate crowdfunding safe?

A: As with any investment, there’s inherent risk. Carefully research projects, understand the platform’s terms, and never invest more than you can afford to lose.

Q: What are some popular real estate crowdfunding platforms?

A: Fundrise, RealtyMogul, and Streitwise are some well-established names. However, conducting thorough research is crucial before choosing a platform.

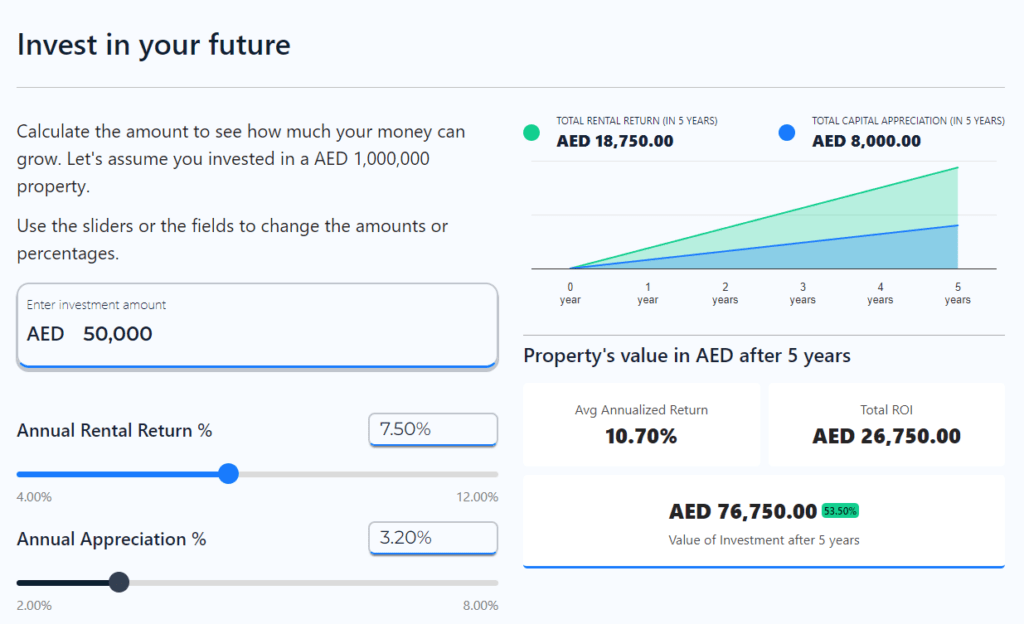

Q: How much can I earn with real estate crowdfunding?

A: Projected returns vary depending on the project and market conditions. It’s wise to manage expectations and prioritize long-term investment goals.

Alternatives to Real Estate Crowdfunding:

While real estate crowdfunding opens doors for many, it might not be the perfect fit for everyone. Here are some compelling alternatives to consider:

- REITs (Real Estate Investment Trusts):

REITs are essentially companies that own and operate income-generating real estate properties. You can invest in these companies through the stock market, similar to buying shares in any other publicly traded company. This offers several advantages:

- High Liquidity: REITs trade on stock exchanges, allowing you to easily buy and sell shares.

- Professional Management: REITs are managed by experienced professionals, taking the burden of property management off your shoulders.

- Diversification: REITs often hold a portfolio of various properties, offering built-in diversification within your investment.

However, keep in mind that:

- Direct Ownership vs. Shares: With REITs, you don’t own a piece of the property itself, but rather shares in a company that does.

- Market Fluctuations: REIT share prices can fluctuate with the stock market, potentially leading to short-term losses.

How to Choose a Real Estate Crowdfunding Platform:

Selecting the right platform is crucial for a smooth and secure real estate crowdfunding experience. Here are key factors to consider:

- Platform Fees: Look for platforms with transparent fee structures. Fees can include acquisition fees, management fees, and performance fees. Compare these fees across different platforms to find the most cost-effective option.

- Track Record: Research the platform’s history and performance. Check past projects, investor success stories, and any regulatory complaints.

- Investor Protections: Make sure the platform offers safeguards for your investment. Look for features like escrow accounts that hold your funds securely until the project reaches its funding goal. Additionally, consider platforms with robust investor communication and reporting systems.

Tips for Successful Real Estate Crowdfunding Investment:

Real estate crowdfunding can be a rewarding experience, but it requires a strategic approach. Here are some tips to maximize your chances of success:

Conduct Due Diligence:

Don’t just throw your money at the first project that catches your eye. Research the project thoroughly, and understand the property type, location, market dynamics, and the development team’s experience. Read offering documents carefully and ask the platform questions if anything is unclear.

Understand the Risks:

Real estate crowdfunding involves inherent risks. Be prepared for potential delays, lower-than-anticipated returns, or even project failure. Invest only what you can comfortably afford to lose and avoid putting all your eggs in one basket.

Invest for the Long Term:

Real estate crowdfunding is not a get-rich-quick scheme. Think long-term and set realistic expectations for returns. Consider this investment as part of a diversified portfolio with a horizon of several years.

The Final Word

Real estate crowdfunding offers a novel and accessible way to enter the real estate investment arena.

By understanding the mechanics, potential benefits, and drawbacks, you can make informed decisions and potentially unlock a new avenue for wealth creation.

Remember, proper research and a well-diversified investment strategy are key to navigating this exciting investment landscape.