The real estate market in Sharjah has been rapidly growing, attracting both local and international investors. However, one crucial factor that often gets overlooked by many investors is the role of foreign exchange rates.

These rates can significantly impact the profitability of real estate investments, especially for foreign investors. Understanding how these rates work and their influence on the market is essential for making informed decisions.

Understanding Foreign Exchange Rates

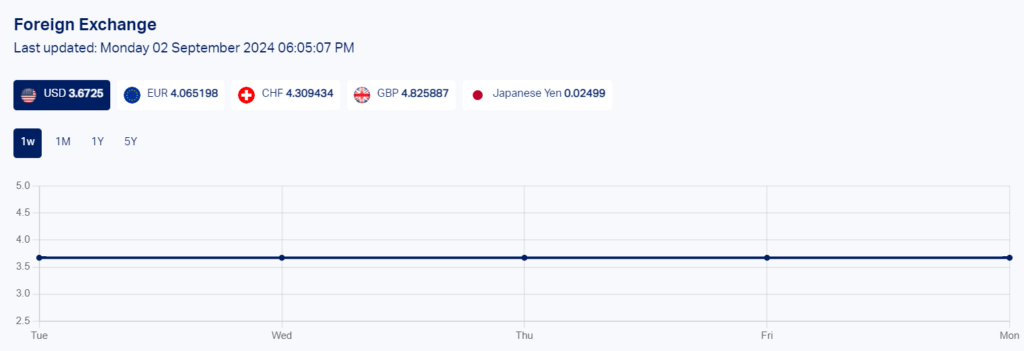

Foreign exchange rates, often referred to as forex or FX rates, determine the value of one currency against another. These rates fluctuate constantly due to various global economic factors, including interest rates, inflation, and geopolitical events.

Understanding these fluctuations is key to making profitable real estate investments, particularly in a market like Sharjah that attracts a diverse group of investors.

Exchange rates are influenced by supply and demand dynamics in the currency market. When a currency is in high demand, its value increases relative to other currencies.

Conversely, when demand is low, its value decreases. Central banks, through monetary policies, also play a significant role in determining these rates.

The Real Estate Market In Sharjah

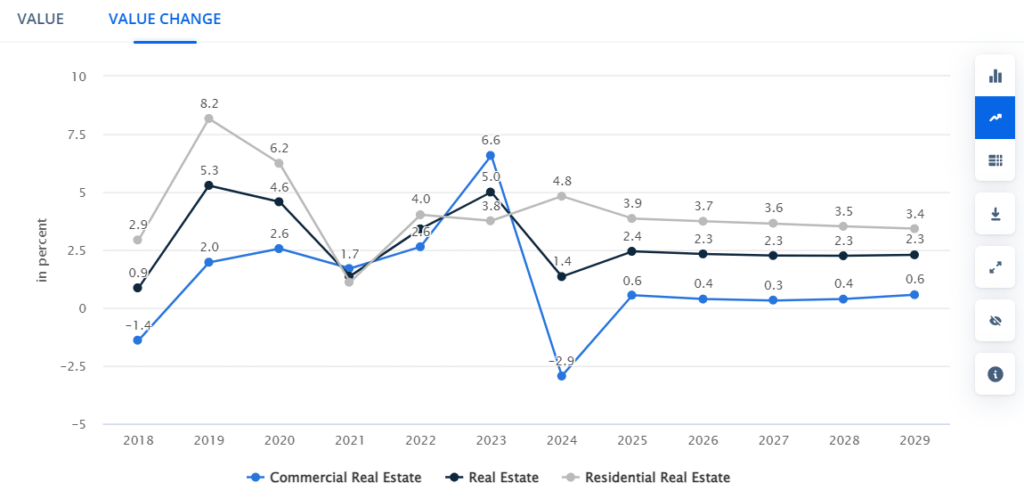

Sharjah’s real estate market has seen substantial growth over the past decade, driven by factors such as population growth, infrastructure development, and favorable government policies.

The market is known for its affordability compared to other emirates like Dubai, making it an attractive destination for investors.

Foreign investors play a significant role in Sharjah’s real estate sector, bringing in capital from various countries.

These investments are often influenced by the exchange rates between the investor’s home currency and the UAE dirham.

A favorable exchange rate can make a property purchase more affordable, while an unfavorable rate can increase the cost.

Foreign Exchange Rates and Real Estate Investment

The influence of exchange rates on property prices cannot be overstated. When the investor’s home currency strengthens against the UAE dirham, they can buy more property for the same amount of money, effectively getting a discount. On the other hand, if their currency weakens, the cost of investment increases.

Currency fluctuations also affect the return on investment (ROI). For example, if a property is purchased when the investor’s currency is strong and sold when it is weak, the ROI may be lower than expected. Investors need to monitor these rates closely to maximize their returns.

Risks Associated with Currency Fluctuations

Currency fluctuations and foreign exchange rates pose a significant risk to real estate investors. Exchange rate risk refers to the potential for an investor’s home currency to depreciate against the dirham, leading to increased costs or reduced profits.

To mitigate this risk, investors can use strategies such as currency hedging, where they enter into financial contracts to lock in current exchange rates for future transactions.

Another strategy is to diversify investments across different markets or currencies. This approach helps spread the risk, ensuring that if one currency depreciates, the impact on the overall investment portfolio is minimized.

Benefits of Monitoring Exchange Rates

By keeping a close eye on exchange rates, investors can identify opportunities for cost-effective investments. For instance, purchasing property when the exchange rate is favorable can lead to significant savings.

Moreover, understanding currency trends allows investors to time their property purchases and sales more effectively, optimizing their profits.

Investors who actively monitor foreign exchange rates are better positioned to enhance their profitability. They can take advantage of favorable currency movements to secure better deals on properties or financing, thereby maximizing their returns.

Exchange Rates and Financing Real Estate in Sharjah

Exchange rates also play a crucial role in financing real estate investments. For foreign investors, currency fluctuations can affect the cost of mortgages or loans.

If the investor’s home currency weakens, their mortgage payments in dirhams become more expensive. Conversely, if their currency strengthens, the cost of financing decreases.

To secure favorable financing terms, investors should consider locking in exchange rates when taking out loans. This strategy can protect them from adverse currency movements, ensuring that their financing costs remain stable throughout the loan term.

Exchange Rate Predictions and Market Trends

Financial experts often analyze market trends and global economic conditions to predict exchange rate movements.

These predictions can help investors forecast real estate prices in Sharjah, allowing them to make informed decisions. Staying informed about these trends is crucial for timing investments and maximizing returns.

Investors should also pay attention to the broader economic environment, including factors such as interest rates, inflation, and political stability. These elements can all influence exchange rates and, consequently, the real estate market in Sharjah.

The Role of Government Policies

Sharjah’s government policies have a significant impact on the real estate market, particularly concerning foreign investment.

Policies that encourage foreign ownership and streamline the investment process can attract more international buyers, influencing exchange rates and property prices.

Additionally, currency regulations imposed by the government can affect real estate transactions. For example, restrictions on currency exchange or capital flows can make it more challenging for foreign investors to transfer funds, impacting their ability to invest in Sharjah.

Several real-life examples highlight the impact of exchange rates on real estate investments in Sharjah. For instance, a foreign investor who purchased property during a period of favorable exchange rates may have experienced significant gains when selling the property later.

On the other hand, investors who did not consider currency fluctuations may have faced unexpected costs, reducing their overall profits.

These case studies underscore the importance of considering exchange rates when investing in Sharjah’s real estate market. Learning from these examples can help investors avoid common pitfalls and make more informed decisions.

Long-Term vs. Short-Term Investments

The impact of exchange rates varies depending on whether the investment is long-term or short-term.

Long-term investments are generally less affected by short-term currency fluctuations, as the investor has more time to ride out any unfavorable movements.

However, long-term investors still need to consider the potential for significant currency shifts over time.

Short-term investments, on the other hand, are more sensitive to currency changes and foreign exchange rates. Investors need to be particularly vigilant about exchange rates, as even small fluctuations can have a substantial impact on their returns.

Balancing currency risks with investment goals is crucial for both long-term and short-term investors.

Tips for Real Estate Investors in Sharjah

For those looking to invest in Sharjah’s real estate market, here are some best practices:

- Stay informed about currency trends: Regularly monitor exchange rates and economic news to anticipate potential changes.

- Diversify your investment portfolio: Spread your investments across different currencies and markets to mitigate risks.

- Use currency hedging tools: Consider financial instruments that allow you to lock in favorable exchange rates for future transactions.

- Consult with experts: Seek advice from financial and real estate professionals to make informed decisions.

- Leverage technology: Use apps and online platforms to track exchange rates and property prices in real time.

Foreign exchange rates play a critical role in Sharjah’s real estate market, influencing everything from property prices to financing costs.

By understanding and monitoring these rates, investors can make more informed decisions, mitigate risks, and maximize their returns.

As Sharjah continues to grow as a real estate hub, staying attuned to global economic trends and exchange rate movements will be increasingly important for investors looking to succeed in this dynamic market.

FAQs

1. How do foreign exchange rates affect property prices in Sharjah?

Foreign exchange rates can impact the affordability of properties for foreign investors. A stronger home currency means that investors can buy more for less, while a weaker currency increases costs.

2. What strategies can investors use to mitigate exchange rate risks?

Investors can use currency hedging, diversify their investments, and stay informed about global economic trends to manage exchange rate risks.

3. How can foreign investors secure financing in Sharjah?

Foreign investors should consider locking in exchange rates when securing loans and work with financial institutions that offer favorable terms for international buyers.

4. Are there government policies that impact exchange rates in real estate transactions?

Yes, government policies, including currency regulations and investment incentives, can influence exchange rates and affect real estate transactions.

5. What are the long-term effects of exchange rates on real estate investments?

Over the long term, significant currency shifts can impact the profitability of real estate investments. Investors need to consider potential currency movements when planning their investment strategies.