The UAE’s property market is a dynamic and lucrative sector that attracts residents and investors worldwide.

With its towering skyscrapers, luxurious villas, and prime real estate locations, deciding whether to rent or buy a property in the UAE can be a challenging decision.

This guide delves into the pros and cons of each option, providing a comprehensive analysis to help you make an informed choice.

A few key trends are visible in the UAE’s real estate market in 2024. Check out these 5 trends so that you can have a better idea about your investment.

Increased Rental Demand:

The rental market has seen significant activity, with Dubai recording a 35.8% increase in rental registrations year-over-year. This trend reflects a strong demand for rental properties, particularly in prime locations.

Rising Rental Rates:

Average rents in Dubai increased by 10.5%, while Abu Dhabi’s rents grew by 14.7%. This upward trend in rental costs can influence the decision-making process for potential renters and buyers alike.

Investment Opportunities:

The UAE is still a magnet for worldwide investors in both residential and commercial sectors. Additionally, the hospitality industry keeps thriving. It takes advantage of more tourists coming and an expanding economy.

Government Initiatives:

The UAE has introduced new initiatives to boost the real estate market. These include residency visas that last a long time for investors and expatriates. These actions invite investment from abroad and create a stable market.

Sustainability and Smart Living:

There is a growing emphasis on sustainability and innovative living solutions in new developments across the UAE. Properties with eco-friendly features and intelligent tech attract more people. It’s hitting the right notes with those who care for our environment and want to rent or buy.

Understanding the UAE Property Market

The UAE’s real estate market has seen exponential growth over the past few decades, transforming from a desert landscape into a global hub of commerce and luxury.

From the development of iconic projects like Palm Jumeirah to the creation of towering landmarks such as the Burj Khalifa, the country has made a name for itself as a premier destination for real estate investment.

Current Market Trends

The UAE’s property market is currently witnessing a surge in demand, particularly in cities like Dubai and Abu Dhabi. With government initiatives aimed at attracting foreign investment and residents, the market has become more accessible, offering a range of options for both renters and buyers. Property prices have stabilized, and rental yields remain attractive, making it a favorable environment for both options.

Key Locations for Property Investment

Some of the top locations for property investment in the UAE include Dubai Marina, Downtown Dubai, Abu Dhabi’s Saadiyat Island, and Al Reem Island. These areas are known for their high rental yields, luxury living, and strong demand, making them ideal choices for both renters and buyers.

Renting Property in the UAE

Advantages of Renting

Renting offers unparalleled flexibility, allowing you to move locations without the long-term commitment of owning a property. This is particularly beneficial for expatriates who may not plan to stay in the UAE permanently.

Lower Upfront Costs

Renting typically requires a security deposit and one or two months’ rent in advance, which is significantly less than the down payment needed to purchase a property.

Minimal Maintenance Responsibilities

As a tenant, you are generally not responsible for major repairs or maintenance. This responsibility falls on the landlord, which can save you both time and money.

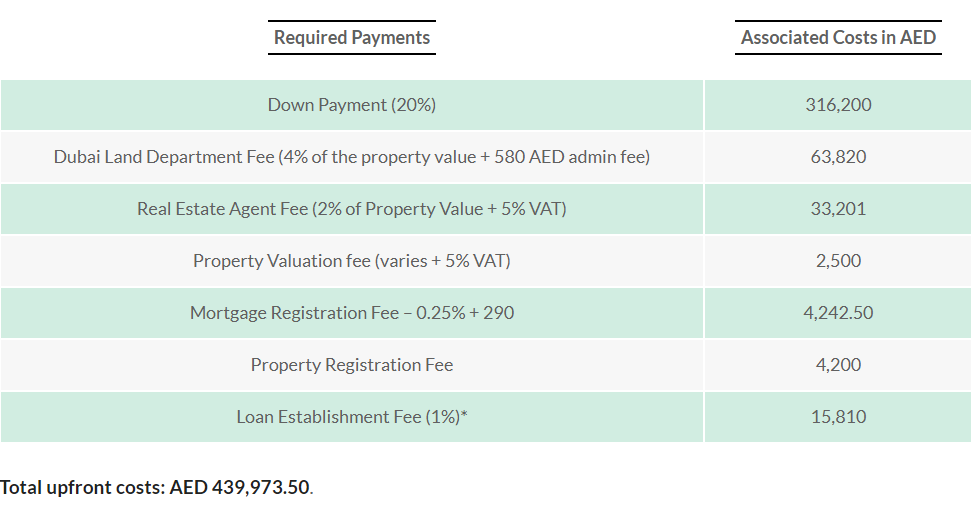

Upfront costs for buying a 1-bedroom apartment in Dubai Marina

What will it cost you to buy a 1-bed Dubai Marina apartment instead of renting it over a period of five years?

Here is how you can calculate the total upfront costs of a 1-bed flat for sale in Dubai Marina costing AED 1,581,000.

Disadvantages of Renting

Lack of Long-term Investment

Renting does not provide any return on investment. The money spent on rent is essentially paying off someone else’s mortgage without building any equity for yourself.

Rent Increases

Over time, rental rates can increase, especially in high-demand areas. This can lead to financial instability, particularly if your income doesn’t keep pace with rising rents.

Limited Personalization

As a renter, you may face restrictions on making changes to the property. This can limit your ability to personalize your living space to suit your tastes and needs.

Buying Property in the UAE

Advantages of Buying

Purchasing a property allows you to build equity over time. Real estate in the UAE is often seen as a stable and appreciating asset, making it a sound investment for the future.

Stability and Control

Owning a property provides a sense of stability and control. You have the freedom to renovate, decorate, and make changes as you see fit, without needing permission from a landlord.

Potential for Rental Income

If you decide to move, you can rent out your property and generate a passive income. The UAE’s rental market is strong, particularly in prime locations, providing an opportunity to earn a significant return on your investment.

Disadvantages of Buying

High Initial Costs

Buying a property requires a substantial upfront investment, including a down payment, mortgage fees, and other associated costs. This can be a barrier for many people, particularly first-time buyers.

Market Fluctuations

The property market can be volatile, with prices fluctuating due to economic conditions, government policies, and other factors. This can affect the value of your investment, both positively and negatively.

Long-term Commitment

Purchasing a property is a long-term commitment, and it may not be suitable for those who prefer flexibility or who may need to relocate frequently for work or personal reasons.

Financial Considerations & Comparing Costs: Renting vs. Buying

When deciding between renting and buying, it’s essential to compare the long-term costs of each option. Renting may seem cheaper in the short term, but over time, the cost of rent can add up, especially with annual increases. Buying, on the other hand, involves higher upfront costs but can be more cost-effective in the long run, especially if property values are appreciated.

Mortgage Availability and Interest Rates

The UAE offers a range of mortgage options for property buyers, with competitive interest rates and flexible repayment terms. However, securing a mortgage may require a significant down payment and a strong credit history. It’s essential to compare different mortgage products and consider the long-term financial commitment.

Taxes and Additional Fees

While the UAE is known for its tax-free environment, there are still fees associated with buying property, including registration fees, agent commissions, and maintenance charges. It’s important to factor these costs into your decision-making process.

Legal Aspects of Renting and Buying

Lease Agreements and Tenant Rights

Renting in the UAE involves signing a lease agreement that outlines the terms and conditions of the tenancy. It’s crucial to understand your rights as a tenant, including the notice period for vacating the property, the process for rent increases, and the maintenance responsibilities.

Property Ownership Laws in the UAE

The UAE has specific laws governing property ownership, particularly for expatriates. In certain areas, known as freehold zones, foreigners can purchase property outright. In other areas, ownership is restricted, and expatriates may only be able to lease land on a long-term basis.

Foreign Ownership Regulations

Expatriates can buy property in designated freehold areas, but it’s essential to understand the legal implications and regulations surrounding foreign ownership. This includes the process for transferring ownership, registering the property, and any restrictions on selling or renting out the property.

Lifestyle Considerations

The Impact of Renting on Lifestyle

Renting can offer a more flexible lifestyle, allowing you to live in different areas and experience various aspects of UAE life. It’s ideal for those who value mobility and are not ready to commit to a specific location.

How Buying Influences Your Lifestyle

Owning a property can provide a sense of permanence and stability, allowing you to establish roots in a community. It’s a suitable option for those who plan to stay in the UAE long-term and want to invest in their future.

Family and Long-term Planning

For families, buying a property may offer a more stable environment, with the ability to modify the home to suit the needs of growing children. It also provides a sense of security, knowing that you have a permanent place to call home.

Case Studies and Real-Life Examples

Renting Success Stories

Many expatriates have found success in renting, enjoying the flexibility to move as needed for work or personal reasons. For example, a family who moves frequently for job assignments might find renting to be the most practical and cost-effective option.

Buying Success Stories

On the other hand, those who have purchased property in the UAE have benefited from the appreciation in property values and the ability to generate rental income. For instance, an investor who bought an apartment in Dubai Marina a few years ago may now be enjoying significant returns on their investment.

Mixed Experiences

There are also cases where individuals have experienced both the pros and cons of renting and buying. For example, a person who initially rented in Dubai but later decided to buy may have faced challenges such as navigating the mortgage process but ultimately found it rewarding to own property.

Making the Decision: Renting vs Buying

Evaluating Personal Financial Situation

Your personal financial situation plays a crucial role in deciding whether to rent or buy. Consider your savings, income stability, and future financial goals before making a decision.

Long-term Goals and Aspirations

Think about your long-term goals, such as where you see yourself living in the next five to ten years. If you plan to stay in the UAE for an extended period, buying might be more advantageous. However, if you prefer flexibility, renting could be the better option.

Seeking Professional Advice

It’s always wise to seek professional advice when making significant financial decisions. Consult with real estate agents, financial advisors, and legal experts to get a comprehensive understanding of your options.

Deciding whether to rent or buy property in the UAE is a significant decision that depends on various factors, including financial considerations, lifestyle preferences, and long-term goals. Both options have their advantages and disadvantages, and what works best for one person may not be suitable for another. By carefully weighing the pros and cons, evaluating your personal situation, and seeking professional advice, you can make an informed decision that aligns with your needs and aspirations.

FAQs

Is it better to rent or buy in Dubai?

It depends on your financial situation, long-term plans, and lifestyle preferences. Renting offers flexibility, while buying provides stability and investment potential.

What are the hidden costs of buying property in the UAE?

Hidden costs can include maintenance fees, registration fees, mortgage interest, and agent commissions. It’s essential to budget for these when considering a purchase.

Can expats own property in the UAE?

Yes, expats can own property in designated freehold areas. However, it’s crucial to understand the legal requirements and restrictions associated with foreign ownership.

How does the rental market in Abu Dhabi compare to Dubai?

The rental market in Abu Dhabi is generally more affordable than in Dubai, but both cities offer a range of options depending on your budget and lifestyle needs.

What should I consider before buying property in the UAE?

Consider factors such as location, property type, market trends, mortgage availability, and legal aspects before making a purchase.