The real estate market is a dynamic entity, constantly fluctuating between periods of growth and contraction.

Understanding these cycles is crucial for anyone involved in real estate, whether you’re a seasoned investor, a first-time homebuyer, or a real estate professional.

The ability to anticipate and react to different phases of the market cycle can significantly impact your financial outcomes. But what exactly is the real estate market cycle, and why is it so important to grasp its nuances?

What Is The Real Estate Market Cycle?

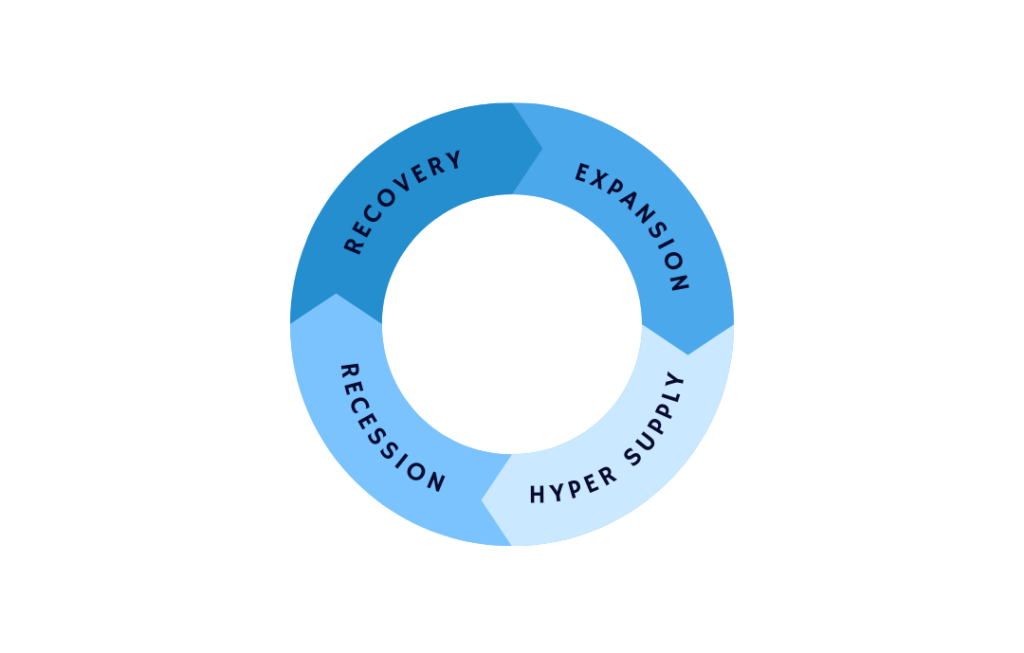

The real estate market cycle is a pattern that the real estate market tends to follow, characterized by four distinct phases: recovery, expansion, hyper-supply, and recession. These phases repeat over time, influenced by a variety of economic, social, and psychological factors.

Recovery Period In The UAE Real Estate Market

The recovery period is the first phase in the real estate market cycle. It occurs after a recession when the market begins to stabilize and show signs of improvement. During this phase, property prices may still be low, but there are indications of increasing demand.

Construction activities resume and vacancy rates begin to decrease. Investors who recognize the early signs of recovery can capitalize on lower prices before the market enters the expansion phase.

A recovery period in the real estate market is the phase following a downturn in the real estate market cycle. The real estate market cycle typically includes four phases: recovery, expansion, hyper-supply, and recession. During the recovery phase, conditions begin to improve after a recession, vacancy rates start to decline, construction is minimal, rental rates stabilize or increase slightly, and investor confidence begins to return. It’s a gradual process that signals the start of renewed activity and growth in the market.

UAE’s Real Estate Market & History of Cycles

The UAE’s real estate market has experienced several cycles, including periods of rapid growth followed by downturns. These fluctuations align with the real estate market cycle, which typically consists of four phases: recovery, expansion, hyper-supply, and recession. Each phase reflects changes in supply, demand, pricing, and investor behavior. These cycles in the UAE have been influenced by various factors, such as global economic conditions, oil prices, and government policies.

- 2008 Global Financial Crisis: The UAE’s real estate market was significantly impacted by the 2008 global financial crisis. Property prices experienced a sharp decline, and construction projects were halted or delayed.

- Post-Crisis Recovery: In the years following the crisis, the UAE government implemented measures to stimulate economic growth and stabilize the real estate market. These efforts included infrastructure development, visa reforms, and incentives for foreign investment.

- Recent Trends: In recent years, the UAE’s real estate market has shown signs of recovery, with increasing demand for properties, particularly in key cities like Dubai and Abu Dhabi. Factors driving this recovery include economic growth, infrastructure development, and attractive investment opportunities.

Key Indicators Of A Recovery Period

To determine if the UAE’s real estate market is in a recovery period, several key indicators can be considered:

- Property Prices: A gradual increase in property prices over time is a positive sign of recovery.

- Sales Volume: Rising sales volume indicates increased demand and investor confidence.

- Rental Yields: Improving rental yields suggest a growing demand for rental properties.

- Investor Sentiment: Positive sentiment among investors and developers is essential for market recovery.

Recommendations For Accelerating Recovery

To accelerate the recovery of the UAE’s real estate market, the following recommendations can be considered:

- Government Policies: Continued support from the government, such as infrastructure development, visa reforms, and incentives for foreign investment, can help boost market confidence.

- Affordable Housing Initiatives: Implementing affordable housing programs can increase accessibility to homeownership and stimulate demand.

- Diversification: Promoting diversification within the real estate sector, including commercial, industrial, and hospitality properties, can reduce reliance on residential markets.

- Sustainable Development: Focusing on sustainable development practices can attract environmentally conscious investors and enhance long-term market stability.

By carefully considering these factors and implementing appropriate strategies, the UAE can continue to strengthen its real estate market and ensure a sustainable recovery.

Expansion Phase In The UAE Real Estate Market

The expansion phase is marked by a growing economy, increasing property values, and high demand for real estate. This is when the market is thriving, with new developments and high transaction volumes.

Understanding Expansion Phase

An expansion phase in the real estate market is a period characterized by rapid growth in property prices, sales volume, and construction activity. It’s often driven by factors such as economic prosperity, low interest rates, and increased investor confidence.

UAE’s Real Estate Market & History of Expansions

The UAE’s real estate market has experienced several expansion phases throughout its history. These periods have been marked by significant increases in property values, particularly in key cities like Dubai and Abu Dhabi.

- Pre-2008 Boom: The period leading up to the 2008 global financial crisis witnessed an unprecedented boom in the UAE’s real estate market. Property prices soared, driven by factors such as economic growth, infrastructure development, and foreign investment.

- Post-Crisis Recovery and Resurgence: Following the economic downturn in 2008, the UAE’s real estate market gradually recovered and experienced a resurgence. Government initiatives, coupled with economic growth and increased investor confidence, contributed to the market’s revival.

- Recent Expansions: In recent years, the UAE’s real estate market has continued to expand, with certain sectors, such as commercial and industrial properties, experiencing significant growth. Factors driving this expansion include economic diversification, infrastructure projects, and attractive investment opportunities.

Key Indicators of an Expansion Phase

To identify an expansion phase in the UAE’s real estate market, several key indicators can be considered:

- Property Prices: Rapidly increasing property prices, particularly in certain sectors or locations, are a strong indicator of expansion.

- Sales Volume: High sales volume, both for residential and commercial properties, signifies strong demand.

- Construction Activity: Increased construction activity, including new developments and projects, is a sign of market expansion.

- Investor Sentiment: Positive sentiment among investors and developers, characterized by optimism and confidence, is essential for a sustained expansion.

Recommendations for Managing Expansion

While an expansion phase is generally positive, it’s important to manage it effectively to prevent excessive speculation and potential market instability. Some recommendations include:

- Government Regulation: Implementing appropriate regulations to control speculative activity and ensure market stability can help prevent excessive price increases.

- Diversification: Encouraging diversification within the real estate sector can reduce the risk of a market crash if one sector experiences a downturn.

- Sustainable Development: Promoting sustainable development practices can help ensure the long-term viability of the market and reduce its environmental impact.

- Affordable Housing: Implementing affordable housing initiatives can help address the growing demand for housing and prevent excessive price appreciation.

By carefully monitoring market trends and implementing appropriate measures, the UAE can manage its real estate expansion phase effectively and ensure a sustainable and prosperous market.

Investors flock to the market during this phase, seeking to benefit from rising prices and rental incomes. However, it’s important to be cautious during expansion, as the market can quickly transition into the next phase if supply outpaces demand.

Hyper Supply Stage In The UAE Real Estate Market

Hypersupply occurs when the market becomes oversaturated with new properties. Despite continued construction and development, demand begins to wane.

A hypersupply stage in the real estate market occurs when there is an excessive supply of properties relative to demand. This can lead to a decline in property prices, increased vacancy rates, and reduced profitability for developers and investors.

UAE’s Real Estate Market & History of Hyper Supply

The UAE’s real estate market has experienced periods of hyper-supply, particularly during and following economic downturns.

- 2008 Global Financial Crisis: The aftermath of the 2008 global financial crisis saw a significant increase in the supply of properties in the UAE, especially in Dubai. This was due to a combination of factors, including halted construction projects, foreclosures, and reduced demand.

- Recent Trends: In recent years, certain sectors of the UAE’s real estate market have faced challenges related to oversupply. For example, the office market in some cities has experienced a surplus of available space due to increased construction activity and economic slowdown.

Key Indicators of Hyper Supply

To identify a hypersupply stage in the UAE’s real estate market, several key indicators can be considered:

- High Vacancy Rates: Increasing vacancy rates for both residential and commercial properties are a strong indicator of oversupply.

- Declining Property Prices: A decline in property prices, particularly in certain sectors or locations, is often associated with hyper-supply.

- Increased Foreclosures: A rise in foreclosures can be a sign of financial distress among property owners and developers.

- Reduced Construction Activity: A decrease in new construction projects suggests a slowdown in market activity and potential oversupply.

Recommendations to Address Hyper Supply

Addressing hypersupply in the real estate market requires a combination of strategies to reduce excess supply and stimulate demand:

- Government Intervention: Government policies, such as incentives for property buyers, restrictions on new construction, or support for distressed developers, can help alleviate hyper supply.

- Market Absorption: Encouraging market absorption through measures like rental incentives or affordable housing programs can increase demand and reduce excess supply.

- Diversification: Promoting diversification within the real estate sector can help balance supply and demand across different property types.

- Long-Term Planning: Implementing long-term urban planning strategies can ensure that future development aligns with actual demand and avoids future oversupply issues.

By carefully monitoring market conditions and implementing appropriate measures, the UAE can effectively address hypersupply and maintain a balanced and sustainable real estate market.

This can lead to increased vacancy rates and a slowdown in price appreciation. Investors should be wary during this phase, as the market is at risk of entering a recession if the oversupply is not corrected.

Recession Stage In The UAE Real Estate Market

A recession in the real estate market is characterized by declining property values, reduced demand, and increased vacancy rates.

A recession in the real estate market is a period characterized by a significant decline in property prices, sales volume, and construction activity. It’s often associated with economic downturns, increased unemployment, and reduced investor confidence.

UAE’s Real Estate Market & History of Recessions

The UAE’s real estate market has experienced several recessions throughout its history, primarily driven by global economic events and changes in oil prices.

- 2008 Global Financial Crisis: The most significant recession in the UAE’s real estate market occurred following the 2008 global financial crisis. Property prices plummeted, construction projects were halted, and many developers faced financial difficulties.

- Other Recessions: The UAE’s real estate market has also experienced smaller recessions in the past, often tied to fluctuations in oil prices and regional economic conditions.

Key Indicators of a Recession

To identify a recession in the UAE’s real estate market, several key indicators can be considered:

- Declining Property Prices: A significant decline in property prices across various sectors is a strong indicator of recession.

- Reduced Sales Volume: Decreased sales volume for both residential and commercial properties reflects a decline in demand.

- Increased Vacancy Rates: Rising vacancy rates for residential and commercial properties indicate a surplus of supply relative to demand.

- Economic Downturn: A broader economic downturn, characterized by factors like increased unemployment and reduced consumer spending, often accompanies a real estate recession.

Recommendations to Mitigate Recession

While it’s difficult to completely avoid recessions, governments and policymakers can implement strategies to mitigate their impact on the real estate market:

- Government Stimulus: Fiscal and monetary policies, such as interest rate cuts, tax incentives, and infrastructure spending, can help stimulate economic activity and support the real estate market.

- Regulatory Reforms: Streamlining regulations and improving the business environment can encourage investment and boost market confidence.

- Diversification: Promoting diversification within the real estate sector can help reduce its vulnerability to economic downturns.

- Long-Term Planning: Implementing long-term urban planning strategies can ensure that the market is resilient to economic shocks and can recover more quickly from recessions.

By understanding the signs of a recession and implementing appropriate measures, the UAE can mitigate its impact on the real estate market and promote a more resilient and sustainable economy.

Economic downturns, high interest rates, or oversupply can trigger this phase. During a recession, it’s crucial to adopt defensive strategies, such as reducing exposure to high-risk investments and focusing on cash flow management.

The Importance Of Timing In Real Estate

Timing is everything in real estate. Entering or exiting the market at the right moment can make a significant difference in your investment returns.

For example, buying during the recovery phase allows you to benefit from future price increases, while selling during the expansion phase can maximize your profits. On the other hand, poor timing, such as buying during hyper-supply or selling during a recession, can lead to losses.

Economic Factors Influencing The Real Estate Market Cycle

Several economic factors play a critical role in shaping the real estate market cycle. Interest rates, for instance, directly affect borrowing costs and, consequently, property demand. Inflation erodes purchasing power, which can either boost or dampen demand depending on how it interacts with wage growth.

Government policies, such as tax incentives or zoning regulations, can also either stimulate or stifle market activity. Additionally, global economic trends, like a recession or a boom in foreign investment, can have ripple effects on local real estate markets.

Psychological Factors In The Real Estate Market Cycle

Beyond economics, psychological factors also drive the market. Market sentiment how investors and buyers feel about the market can influence their decisions to buy or sell.

For example, during the expansion phase of the real estate market cycle, which includes recovery, expansion, hyper-supply, and recession, positive sentiment can lead to a buying frenzy, driving prices even higher. Conversely, during a recession, negative sentiment can exacerbate a market downturn. Media coverage and public perception often shape these sentiments, influencing market behavior on a large scale.

How To Predict Market Cycles

Predicting real estate market cycles, which include the phases of recovery, expansion, hyper-supply, and recession, is challenging but not impossible. Analysts use a variety of tools and techniques, such as economic indicators, historical data analysis, and market sentiment tracking, to forecast potential shifts in the cycle.

While no prediction is foolproof, understanding these signals can help investors make more informed decisions. Consulting with real estate experts who have a deep understanding of market cycles can also provide valuable insights.

Common Mistakes To Avoid In The Real Estate Market

One of the biggest mistakes investors make is misreading the market cycle. This can lead to buying high during a bubble or selling low during a downturn.

Overleveraging, borrowing too much based on the assumption that the market will continue to rise, is a common pitfall during certain phases of the real estate market cycle, particularly in the expansion phase. Ignoring economic indicators, such as rising interest rates or slowing GDP growth, can lead to poor investment decisions and increase vulnerability when the cycle shifts toward hyper-supply or recession.

Long-Term vs. Short-Term Strategies In Real Estate

Investors need to choose between long-term and short-term strategies based on where the market is in the cycle. Long-term strategies, such as buy-and-hold, are generally safer during periods of stability or recovery.

On the other hand, short-term strategies, like flipping, can be profitable during the expansion phase of the real estate market cycle but risky during hyper-supply or recession phases. Understanding the market cycle, which includes recovery, expansion, hyper-supply, and recession, helps investors align their strategies with the current market conditions.

The Role of Real Estate Professionals

Real estate professionals, such as agents and brokers, play a crucial role in navigating the real estate market cycle, which includes recovery, expansion, hyper-supply, and recession. Their experience and knowledge can help clients make informed decisions about whether it’s the best time to buy, sell, or hold. Working with a seasoned professional who understands the intricacies of the market cycle can provide a significant advantage, particularly during uncertain times.

Understanding the real estate market cycle is vital for making informed investment decisions. Each phase of recovery, expansion, hypersupply, and recession presents unique opportunities and challenges.

By recognizing where the market is in the cycle, investors can better time their actions and maximize their returns. Whether you’re a novice or a seasoned investor, keeping an eye on economic indicators, market sentiment, and expert forecasts can help you navigate the complexities of the real estate market.

FAQs

1. What is the most crucial phase in the real estate market cycle?

The expansion phase is often considered the most crucial because it offers the highest profit potential. However, each phase has its importance depending on the investor’s strategy.

2. How often do real estate market cycles occur?

Real estate market cycles typically occur every 10-20 years, but the exact timing can vary depending on various economic factors.

3. Can market cycles be accurately predicted?

While it’s challenging to predict market cycles with complete accuracy, understanding economic indicators and market sentiment can provide valuable clues.

4. What are the risks of not understanding the real estate market cycle?

Not understanding the market cycle can lead to poor investment decisions, such as buying during a peak or selling during a trough, which can result in financial losses.

5. How can investors protect themselves during a recession?

During a recession, investors should focus on maintaining cash flow, reducing debt, and avoiding high-risk investments. It’s also wise to seek advice from experienced real estate professionals.